do i have to pay tax on a foreign gift

The burden of paying the gift tax falls on the gift-giver. What are the tax implications.

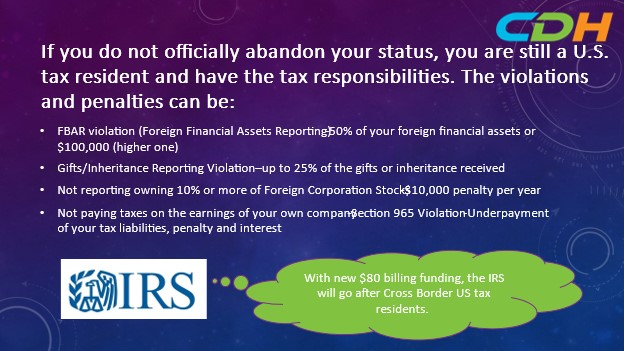

Irs Foreign Reporting Tax Example 2018 Accounts Assets Gifts

DO NOT make any other selections in items 6-8.

. You can receive a gift of as much as 100000 from a foreigner without reporting it as long as it is not paid out through a. Do I Have To Pay Tax On A Foreign GiftGifts from foreign persons gifts from foreign persons. You can gift up to 11180 million in your lifetime without owing this tax but youll.

Under special arrangements the donee person receiving the gift may agree to pay the tax instead. The fact that the gift is from a foreign person is irrelevant. Person other than an organization described in section 501c and exempt from tax under section 501a of the Internal Revenue Code who.

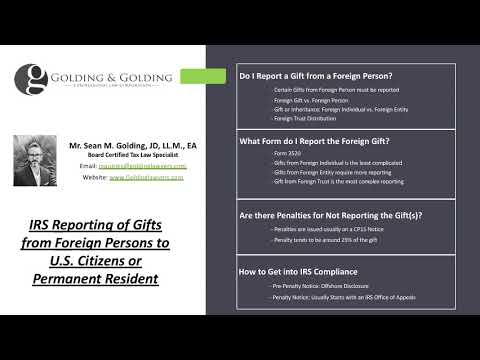

If you are given money from a non-US citizen as a gift however you do need to declare it on Form 3520 if it is over 100000 in value. If required you must report the gift on Form 3520. As the recipient of the gift you do Not report the gift on a US tax return regardless of the amount received.

You will not have to pay tax on this. In cases where gifts are taxable the sender is required to pay tax not the recipient. The gift tax requires you to pay taxes on any large monetary gifts over a certain threshold.

Person receives one or more gifts from a Foreign Person individual entity or trust the recipient may have to report the value to the IRS. Gifts From Foreign Person IRS Reporting. The ONLY option available for gift tax is 6b.

There are forms to repor. If you are on the receiving end of the foreign cash gift you never have to pay income or gift tax on it but you. This value is adjusted.

Enter the tax period MMDDYYYY. The person who does the gifting will be the one who files the gift tax return if necessary and pay any tax due. The IRS defines a foreign gift is money or other property received by a US.

When money is transferred overseas as a gift you may not have to pay taxes on it. If you are a US. The value of the gift or bequest received from a nonresident alien or a foreign estatewhich includes gifts or bequests received from foreign persons related to the.

2020-21This caller is receiving a gift from his family in Bangladesh. I received a foreign gift. Do I have to pay Taxes in the US.

Reporting gifts from a nonresident alien to the IRS. However since the gift is from a foreign person you must report the gift received to. Person who receives a gift.

Line 6 a-c. I have received a large sum of money from a friend in the US as a graduation gift. International Tax Gap Series.

The fact that the gift is from a foreign person is irrelevant. Person from a foreign person that the recipient treats as a gift and can exclude from gross income. Further you must report foreign gifts from foreign corporations or foreign partnerships of more than 16649 as of tax year 2020 on Form 3520.

If the donor does not pay the tax the IRS may collect it from you. I am still studying full-time so currently I dont receive enough income to pay. Typically if a foreigner gifts money or property except intangibles such as.

The same is true for those who receive an inheritance. If the tax period is unknown. This rule stands for.

Gift Tax 3 Easy Ways To Avoid Paying A Gift Tax Taxact Blog

Do I Have To Pay Taxes On A Gift H R Block

How Many People Pay The Estate Tax Tax Policy Center

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

Gifts From Foreign Person How U S Citizens Residents Report A Foreign Gift To Irs On Form 3520 Youtube

2021 2022 Gift Tax Rate What It Is And How It Works Bankrate

2 Fam 960 Solicitation And Or Acceptance Of Gifts By The Department Of State

U S House Panel Probes Trump S Accounting Of Foreign Gifts Reuters

Do Cash Gifts Count As Income 1040 Com Blog

Tax Free Gifts For Real Estate Buyers Housekey Reduce Or Avoid Gift Tax

Tax Tips And Traps Related To Foreign Gifts Gift From Foreign Person

Foreign Gift Taxes What You Need To Report

Tax Implications When Making An International Money Transfer

Must I Pay Taxes On An Inheritance From Foreign Relative

New Jersey Gift Tax All You Need To Know Smartasset